By Neeti Katoch, Amanda Satterly and Anne Valko Celestino

The growing popularity of gender lens investing is backed by evidence that investing in women makes economic sense. Recent research shows that women-owned businesses generate higher revenue on investment compared to men-owned businesses and gender diversity in leadership spurs long-term innovation and creativity. Development finance institutions and investment funds are championing industry initiatives to turn gender-smart investing into actual dollars invested. Tools such as gender equality scorecards help us to get one step closer to successful adoption of gender equality approaches.

Integrating gender analysis to spot opportunities that would be otherwise missed is a powerful investment tool for generating profit while being intentional about creating benefits for women.

The application of a gender lens to private sector investments is receiving an increasing attention from diverse financiers, which raises the question of what the drivers behind this new paradigm are and why they matter to investors. Gender lens investing – or integrating gender analysis to see things that would be otherwise missed – is changing the way financial institutions, and people investing on their behalf, make the decisions on where to invest. This article is building on the argument of why such strategies generate financial returns while creating benefits for women and goes further on providing insights on some innovative approaches to integrate equality into corporate models.

Invest in business, invest in women.

There is a substantial capital gap faced by women entrepreneurs, estimated at over $1.45 trillion, according to the International Finance Corporation. But the situation is improving. Capital raised by private equity, venture capital and private debt funds to invest in businesses that are owned or led by women, or benefit women, quadrupled, between 2017 and 2019, growing from $1.1 billion to over $4.8billion, according to the Wharton Social Impact Initiative.

Providers of equity and loans are realizing that women-led and women-centric businesses are an underserved market, and that they represent quality investment opportunities. Moreover, funds applying a gender lens are expanding geographic focus to emerging markets across Asia and Africa.

The growing popularity of gender lens investing is backed by evidence that investing in women makes economic sense. A study by the Boston Consulting Group found that for every $1 of investment raised, women-owned companies generated $0.78 in revenue compared to $0.31 for men-owned businesses.

Another study, by Credit Suisse, revealed that investors in companies with strong gender diversity strategies receive excess returns of 3.5%, on average. Further, gender diversity in leadership is known to spur long-term innovation and creativity. At the regional level, by eliminating gender inequalities, Asia Pacific can add $ 4.5 trillion to regional annual gross domestic product in 2025, a 12% increase over a ‘no-action’ scenario.

Creating impetus for gender-smart investing

Development finance institutions and multilateral development banks are playing a key role in converting the enthusiasm around gender-smart investing into actual dollars invested and checks written. Industry initiatives championed by international development financiers such as the 2X Challenge have contributed to the mobilization of over $11 billion, with a committed $6.9 billion of investment within just three years (2018-2020) and surpassing the initial goal of $3 billion to finance gender lens initiatives by 2020. The uptake from this success is such that more institutions have now joined the gender financing community and raised the target to $15 billion of capital mobilized for the next three-year period!

Moreover, these initiatives are encouraging a more robust application of gender lens strategies, which have traditionally focused on women-owned companies or women’s representation on boards. Taking investment funds in example as financing vehicles that are set up to provide more agile investments with an impact objective, an increasing number of these funds are looking to develop broad-based, forward-looking gender strategies to realize the full financial and gender-inclusion potential of the investments. Fund managers today typically adopt a two-part approach to gender lens investing. First, gender insights are applied at the origination and portfolio management level to tap into new market opportunities (e.g., women consumer markets) and mitigate risks (e.g., anti-sexual harassment policies). Second, gender lens approaches are applied within the investment firms themselves to strengthen diversity and inclusion in the workplace practices and investment teams. As fund managers consider the multiple aspects of gender equality, there is a growing demand for tools that help in systematic assessment of opportunities and guide gender equality efforts.

A growing number of investors are keen to incorporate gender elements, particularly into their screening or due-diligence processes, or to monitor the gender actions of their investees over time. To support such actions, a number of industry actors ranging from development finance institutions to private investment firms are providing tools and guidance.

Gender Scorecards: what gets measured gets improved

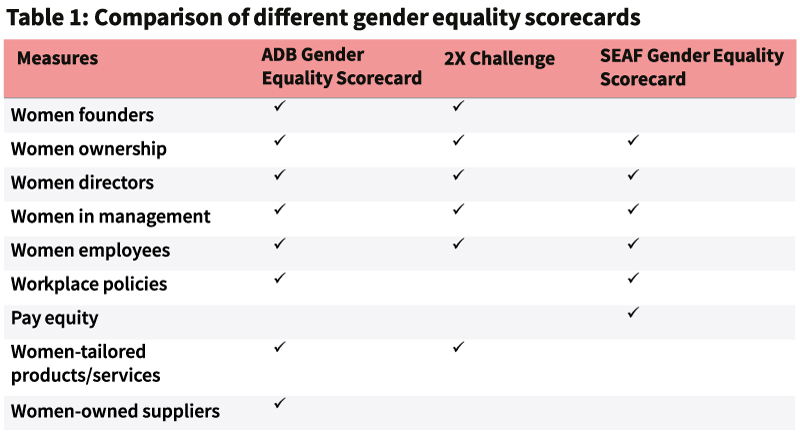

A gender equality scorecard is one such tool that can be applied pre-or post-investments to understand and assess the gender impact potential of opportunities. Most gender equality scorecards measure women’s ownership, women in leadership positions, workplace policies, procurement practices, and women-tailored products and services.

For example, to qualify under the 2X Challenge, investments need to meet at least one of the criteria on women’s access to leadership opportunities, quality forms of employment, finance, as well as product and services that enhance inclusion or economic participation of women. Gender lens investing is increasingly becoming an important area of work for multilateral development banks to enable more companies and investors make gender-informed investment decisions. For instance, the Asian Development Bank has developed a gender equality scorecard primarily for financial intermediaries such as private equity investors, guarantee funds or wholesale banks, to evaluate their respective contributions to gender equality through their investments and operations according to seven metrics (gender balance in ownership, in governing bodies, in leadership, in the workforce, in workplace practices, in products/services and in the supply chain)and against country and sector benchmarks. Investment firms too are increasingly incorporating gender elements into their screening or due-diligence processes, or to monitor the gender actions of their investees over time. Impact investing firms in particular are at the forefront of gender lens investing, adopting innovative tools and building market knowledge. Impact investing firms such as SEAF have launched their own scorecard to advance gender equality through their investments.

Conclusion

We presented here examples of gender equality scorecards as innovative tool to transform interest in advancing gender equality into real action. Yet, the adoption of gender lens investing strategies is not limited to the development finance space. The world of gender lens investing holds tremendous promise, not only to mitigate negative effects on women, but to generate economic returns, build greater resilience to future shocks and support a stable, inclusive global economy. Tools such as scorecards help us to get one step closer to successful adoption of gender equality approaches.

About the Authors

Neeti Katoch, Gender and Private Sector Development Consultant, Private Sector Operations Department, Asian Development Bank.

Neeti is a consultant with Private Sector Operations of Asian Development Bank where she focuses on gender equality and inclusion efforts in the private sector investment projects and operations. Prior to joining ADB, Neeti worked on strengthening sustainability practices and gender mainstreaming in agriculture supply chains and entrepreneurship development across Africa and Asia. Neeti’s experience spans working with TechnoServe, World Bank, Citibank and PwC as a management consultant and a researcher.

Amanda Satterly, Senior Social Development Specialist (Gender and Development) in Private Sector Operations, Asian Development Bank.

Amanda leads the efforts of ADB’s private sector operations to integrate gender into its investment projects and operations. She joined ADB in 2019 after a decade of working to increase the gender inclusiveness of private sector operations in African-based businesses, prior to which she was a management consultant and an investment banker.

Anne Valko Celestino, Gender and Social Development Specialist, Private Sector Operations Department, Asian Development Bank.

Anne is responsible for integrating gender analysis and measures into investment projects and for strategic and operational initiatives to promote gender inclusive solutions in private sector financing. Prior to joining the ADB, Anne has been working with other development finance institutions, and particularly the African Development Bank. She is an experienced professional on social development in investment finance and private sector development, with experience across sectorial operations as well as stakeholder and strategy engagement. She is also qualified in project management and notably managed several institutional initiatives including a major multi-partner flagship program promoting women in business, access to finance and gender equality in economic development.